Turning 18? Tips for health insurance as an adult

Becoming an adult brings with it new freedoms but also a few obligations. What health insurance changes can you expect once you turn 18? What should you be mindful of? And where can you save money? Find answers and tips here.

Exploring the world, starting a training course, your first job, a great love – whatever your current agenda or the adventure you are about to embark on, we can support you by providing the right insurance cover and tailored advice. Read on for a brief overview of the key changes to your health insurance once you turn 18.

What health insurance changes can you expect once you turn 18?

- Your children’s discount will cease to apply. You will switch to the tariff group for young adults as of 1 January following your 18th birthday. You can find out how much your premium will be using the premium calculator on the right.

- You will start to pay a deductible from next January onwards. This is a mandatory co-payment. The higher your chosen deductible, the lower your premium. Change deductible

- Do you work? If you work more than eight hours per week for the same company, you can exclude accident cover – your employer has insured you for accidents.

Do you have the right insurance cover?

From trips abroad to preventive health and complementary medicine – let us advise you on whether your cover is suitable for your current circumstances.

Trying to keep to a budget? Saving tips for young adults

Benefit from our family discount

You can enjoy a 10% family discount on most supplementary insurance policies as long as you live at home and are insured under the same policy (family policy). If there are two family members in the same household, they are eligible for a 5% discount. It is therefore worth waiting until you move out before separating from a policy or taking out your own policy.

Saving with alternative insurance models

When it comes to basic insurance, alternative insurance models such as the general practitioner model offer the best savings potential. Discounts vary depending on the plan, your place of residence and your doctor’s office. Calculate your premium easily online.

Check premium reduction

If you live in modest financial circumstances, you are entitled to a premium reduction. The calculation depends on where you live, so please check with your canton of residence.

Change deductible

As of 1 January following your 18th birthday, you will pay a portion of your medical expenses yourself, for instance for visits to the doctor, prescription medication, laboratory tests and hospital stays. This co-payment comprises the deductible and a 10% excess:

- The lowest available deductible is CHF 300 per year, and the highest CHF 2,500.

- The higher the deductible, the greater the discount on your premium.

- Once the deductible has been fully paid, the health insurance company pays the remaining costs. You pay a 10% excess on this in each case.

- Excesses are limited to CHF 700 per year. Helsana assumes the entirety of the remaining costs.

It all depends on how much medical treatment you require. If you expect annual treatment costs of below CHF 1,800, you are best to opt for the highest deductible of CHF 2,500. Otherwise, the CHF 300 option is the one to choose. We would be happy to advise you personally.

You can change your deductible with effect from 1 January of the following year, provided you inform us by the following dates:

- Reduce deductible: 30 November

- Increase deductible: 31 December

Do you have private or semi-private supplementary hospital insurance? A voluntary hospital deductible offers discounts of 15% to 35%. The lowest deductible is CHF 1,000, the highest CHF 7,000. During a stay in hospital, you pay the hospital deductible as an excess on the hospital invoice.

If you would like to arrange or change a hospital deductible, please get in touch via the myHelsanaclient portal or via contact form by 31 December at the latest.

How to avoid double insurance

Are you employed? Exclude accident cover

Do you work eight hours a week or more for the same employer? If so, you are automatically insured against accidents, including accidents in your leisure time. You can therefore exclude accident coverage from your compulsory basic insurance – and save 7%. We recommend keeping the accident coverage in any supplementary insurance policies. We would be happy to advise you if you are at all unsure.

Military service? Pause basic insurance

If you are engaged in military service for more than 60 consecutive days, you are insured directly through the military.

Suspend your basic insurance before beginning service. To do this, simply send us your marching orders or confirmation that you have started military service. At the end of your military service, please send us the extract from your military service record as confirmation.

Frequently asked questions about health insurance once you turn 18

Once you turn 18, the cost of health insurance premiums jumps as you move up to a new age group. The 75% children’s discount ends when you reach the age of majority. At Helsana, you continue to receive a 20% discount on the adult premium (in Ticino, this is 25%). You will receive this young people’s discount until you reach the age of 25.

Basic insurance covers essential medical needs. It is obligatory for all Swiss residents. Supplementary insurance policies pay for additional benefits such as glasses, complementary medicine, coverage abroad, dental treatments and legal expenses cover. These are voluntary.

Compulsory basic insurance covers the most essential benefits. Supplementary insurance is generally worthwhile. It all comes down to your needs: for instance, do you wear contact lenses or glasses? Do you prefer natural methods of treatment? Do you value your fitness? Or do you frequently travel abroad? If so, basic insurance is not enough. We would be happy to examine your insurance cover to ensure it meets your needs and fits your budget.

You will receive a young people’s discount of 20% (25% in Ticino) on basic insurance with Helsana until the age of 25 – regardless of whether you are studying, on an apprenticeship or have already finished these. Would you like to save on your premium? With basic insurance, you can choose from several different insurance models: options with a free choice of doctor, general practitioner models or telemedicine. The benefits are exactly the same under all models, but the premiums differ.

Whether braces, wisdom teeth extractions or dental hygiene: supplementary insurance is required for dental treatment. Basic insurance only covers rare, specific treatments associated with a dental disease, a congenital defect or dental trauma (cost approval required). Helsana covers varying dental treatment costs depending on your supplementary insurance policy.

Please let us know your new place of residence. If you move to another region, your premium may change, and your family discount may cease to apply. Will any of your other personal details such as your phone number, email address or bank details be changing? If so, you can easily manage your data in the myHelsana-App. Are you moving abroad for a while? Contact us.

You or your parents pay the premium invoice for the insurance cover you have concluded with us. The amount is indicated on the insurance policy. We will issue you – or your authorised parent – with a benefit statement once costs have been incurred for a medical treatment, a lab analysis or medication or once these have been submitted to us for a refund.

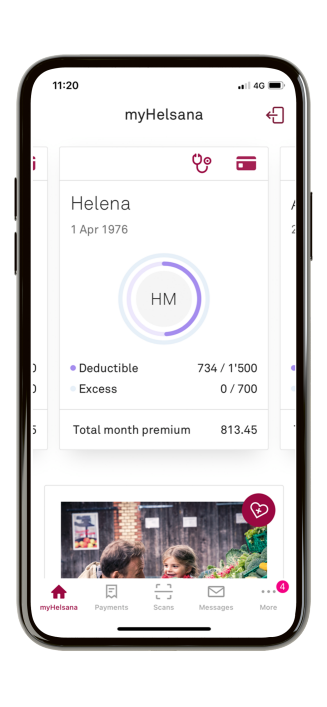

Submit bills and take care of other insurance matters quickly and securely with the myHelsana app. Simply scan the invoice with the app and send it in. The money will be in your account and the benefit statement visible in the app within two weeks.

If you are no longer insured under a family contract and now pay your own premiums, you can choose from eBill (via online banking), direct debit (one-time payment authorisation) or, subject to a fee, QR invoice. The most straightforward of these is eBill – it even offers a standing order option, so you never miss an invoice.

Basic insurance covers medical emergencies. Nonetheless, depending on the country you are travelling to, your costs may not be fully covered. Outside the EU and EFTA countries, there are gaps in cover, including for emergency transport or repatriation to Switzerland. Fill in the gaps with WORLD, TOP or COMPLETA.

In general, yes. You are now an adult and can conclude or terminate contracts. You can even change your insurer if invoices from before you came of age are still outstanding. That’s because your parents are still responsible for paying these.

Recommendations for health insurance once you turn 18

Young, unfettered and ready to explore the world – with adulthood comes endless new possibilities. All the more need for good insurance cover that covers your new needs and risks.

COMPLETA PLUS

More money for gym passes, glasses or contacts, prevention and complementary medicine.

WORLD

Worldwide cover for less – emergency care, missing person searches and return journeys.

ADVOCARE EXTRA

Comprehensive legal expenses cover for online cyberbullying, road or workplace incidents.

Request a consultation

Do you have questions about your insurance cover, or would you like to switch to Helsana? We would be happy to advise you – in person or with a convenient, online video call. Simply fill out the form and we will get in touch.

Thank you for your consultation request, {salutation} {firstname} {lastname}.

Someone from our advisors will be happy to get back to you.

We did not receive your information. Please try again later.

In the meantime, check out some of our health ideas and tips. You’ll find fascinating information about diet, exercise and mindfulness in our blog.

Do you have questions?

We're here to help.